I was getting really sick of foreign transaction fees stacking up in my bank account. And friends kept recommending Wise and Revolut, but all the comparison blogs were too technical. So I signed up for both to see for myself. This is my honest, real-world take on how Revolut vs Wise actually compare for your average traveller.

This is not a sponsored post. Everything is based on personal experience managing money across NZD, CAD, EUR, ZAR, IDR, and more while travelling.

But my website does contain other affiliate links. Purchases generate a commission for me at no extra cost to you. Thanks for your support!

Revolut vs Wise highlights

- Both let you manage multiple currencies

- Both give you a physical and digital card

- Both are easy to manage from your app anywhere in the world

- Revolut offers monthly paid plans with more perks

- Wise is more straightforward and completely free

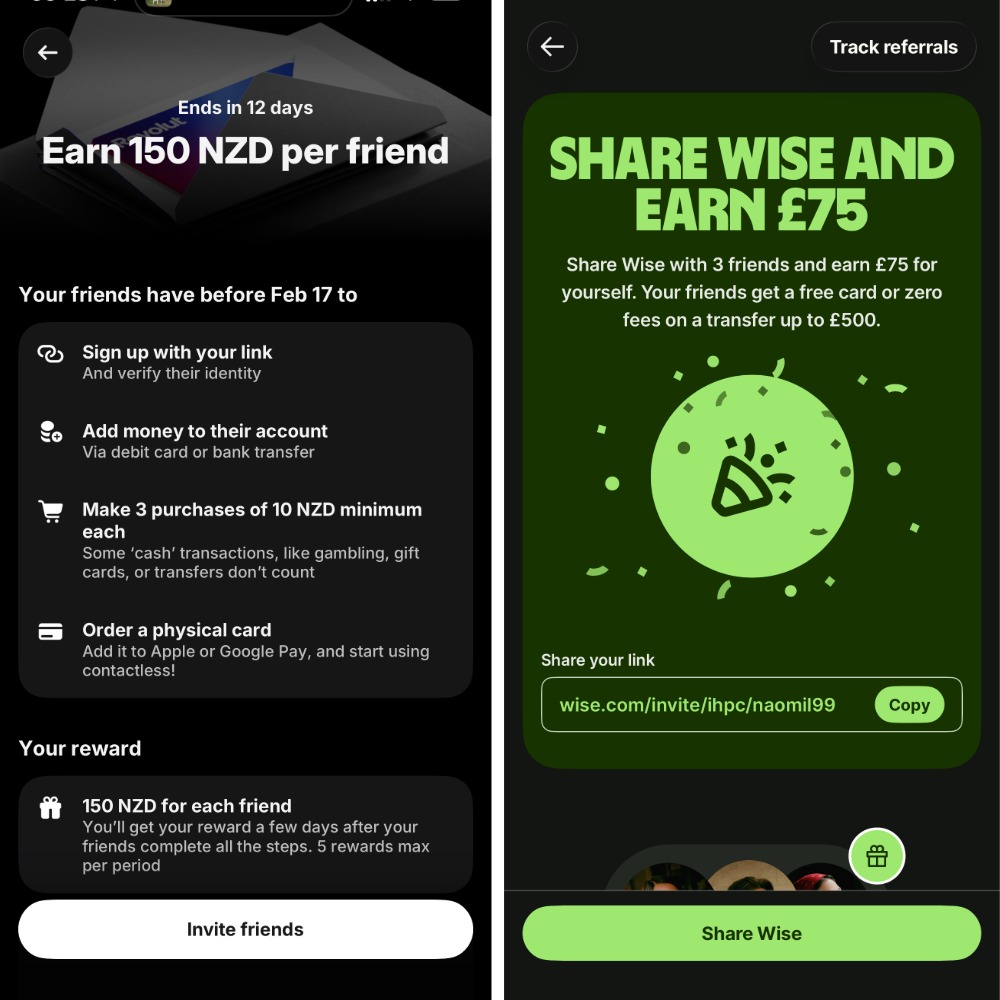

- Both give you cash money bonuses for referring friends

What are Wise and Revolut?

Revolut and Wise make it cheaper to spend and manage money across currencies. They’re basically designed for travellers! While these services shouldn’t replace your regular bank account, they can work nicely alongside it.

I shudder to think of how much money I’ve needlessly lost to “foreign currency fees” and poor exchange rates through my bank. But exchanging currencies in the app means you get a better rate than when you’re at the mercy of your bank or that random ATM.

I use both cards and think they each have value — I’m laying out the pros, cons, and other considerations, but I can’t say I have a major preference between the two options.

Wise

I’ve used Wise for years, mainly just for transfers between my CAD and NZD banks. But I recently started using it more to its full potential when country-hopping and it’s been great!

The app is clean, the exchange rates are legit, and it’s easy for me to freeze/cancel my card if I misplace it. It has also come in handy a couple of times when getting paid internationally.

Someone can send you money as if you have a local bank account, simplifying everything and reducing fees on both sides. Useful if you:

- work with international clients

- want to avoid high transfer fees and exchange markups

- can’t or don’t want to set up local bank accounts in every country

- want to spend like a local in 150+ countries

Wise also offers an international business account, but I just use it on a personal level so I won’t weigh in on that.

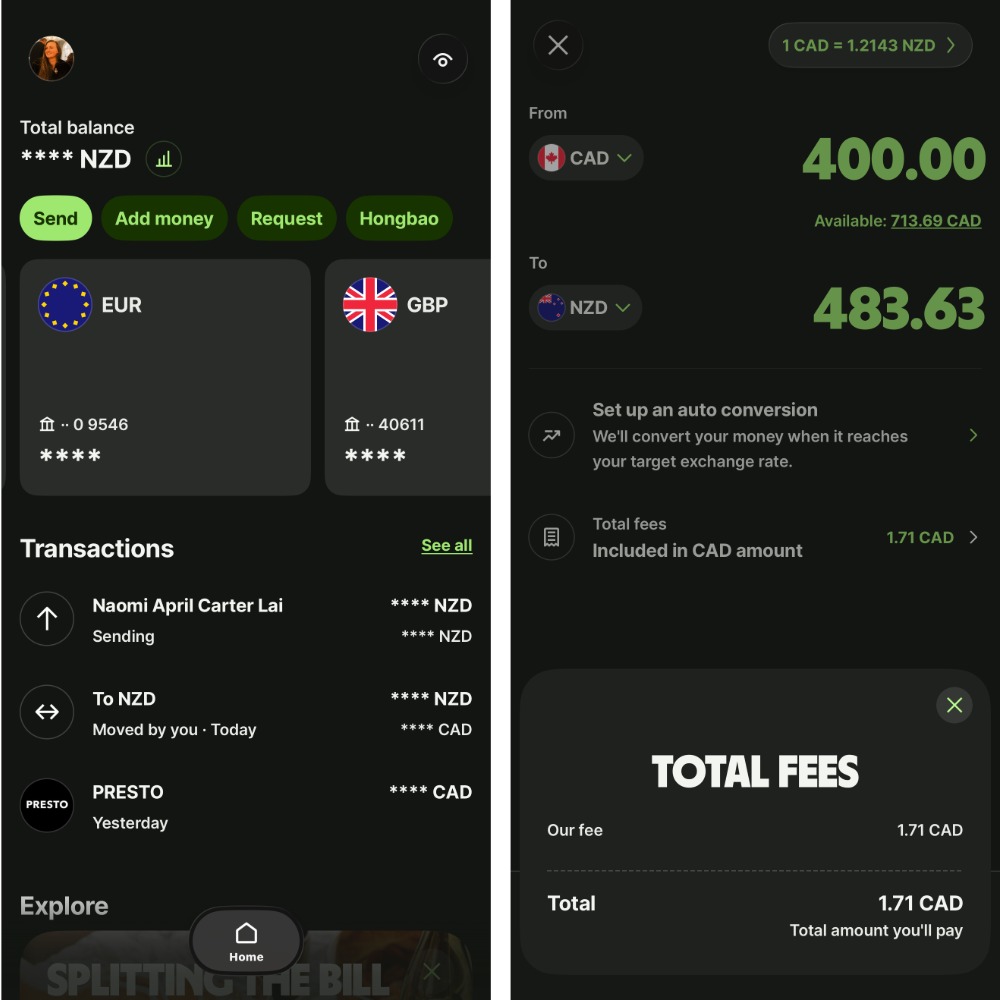

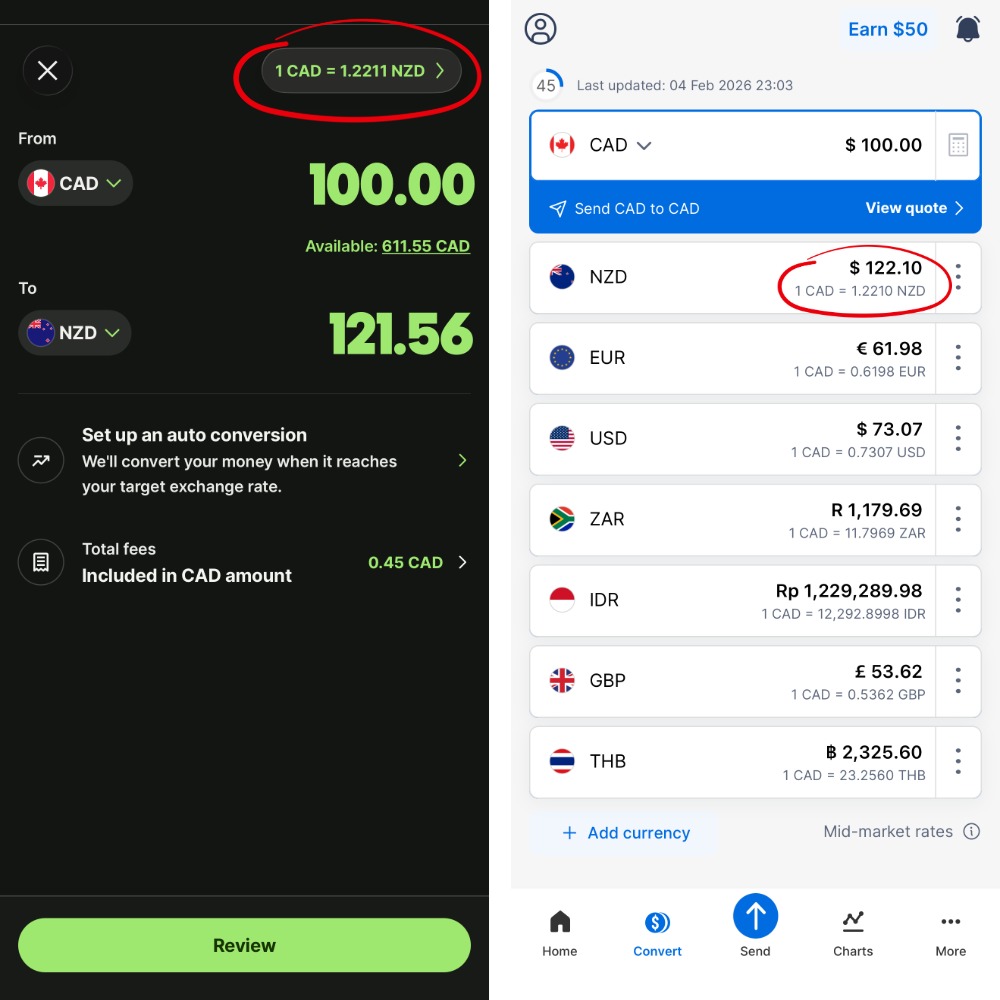

Here’s the home screen (with my account info hidden) and an example of how cheap it is for me to send money between Canada to New Zealand.

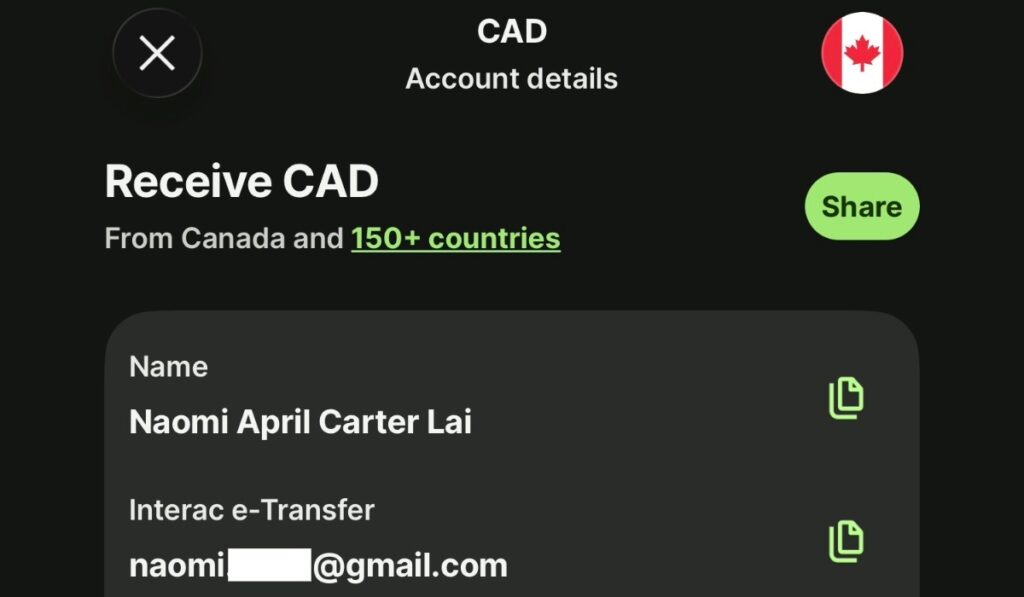

In Canada, Wise works with Interac e-Transfers. Everyone uses this to make fee-free, quick account-to-account transfers.

I don’t have to ask Canadian friends to do anything complicated or download Wise to send me money — I can just give them my email address. Revolut doesn’t currently support this.

Cons of using Wise

The same simplicity that makes Wise so great also comes with limitations.

- No joint account feature. This might not be important to everyone, but was a downside for me and Chesney.

- You get a lime green card whether you like it or not (or an eco-friendly white card). Revolut is more customizable.

- Wise lets you hold 40 currencies. But there are limitations to be aware of in some cases. You can spend in 150+.

Revolut

At its core, Revolut lets you hold and spend multiple currencies and use a debit card abroad — just like Wise. But it layers on a lot more. When I first opened the app, I was like, ahhh there’s a lot going on here, I’m scared! But I got used to it, and the features can be worth it.

- analytics on what you spend

- joint accounts (with other Revolut users)

- crypto and investing in-app

- paid plans with perks like subscriptions and airport lounge access

- accounts for kids/teens if you’re traveling as a family

- colourful, customizable cards

- points accrued per spend

Joint and personal Revolut cards in my Apple wallet

But remember, you don’t have to use every feature!

I keep it simple with the free Revolut plan. And for travel — especially as a couple — it’s been absolutely fine. I ignore most of the extra tabs and features, and just use what I need. I may try to upgrade to a paid tier down the line if I’m using it all the time and want to really take advantage of the perks.

I get a lot of push notifications with offers like a free month of Premium or increased referral bonus. This could be a pro or a con depending on what you’re after.

Cons of using Revolut

- Revolut lets you hold 30+ currencies, which is technically fewer than Wise but very similar.

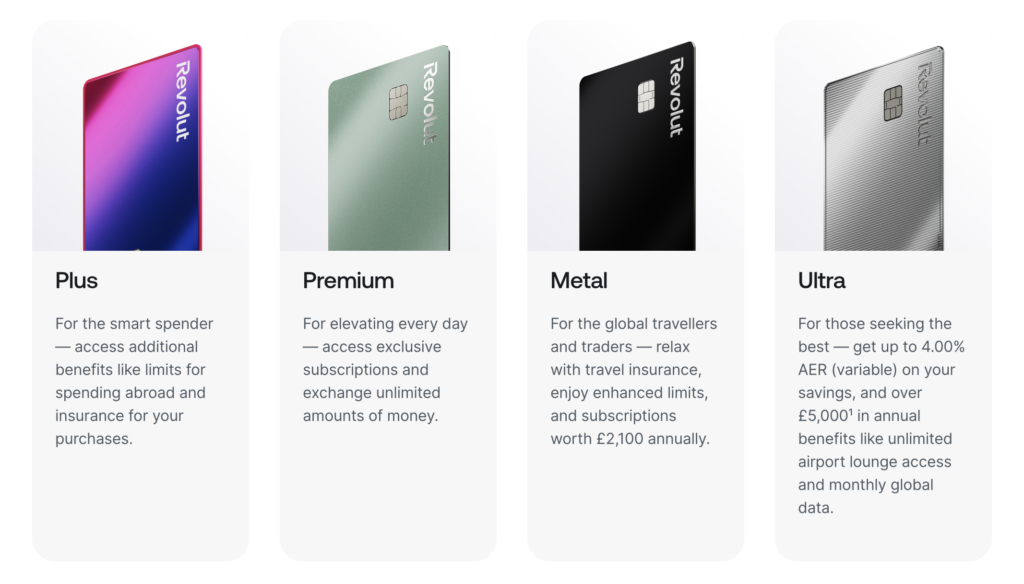

- They lean into the paid plans. These range from £4 to £55 per month. I don’t like the idea of an ongoing cost for any bank card. Fortunately, the free version works totally fine on its own.

- “Free” cards still cost about 20 USD to ship.

For a service that’s all about reducing hidden banking fees, it sure has a few hidden banking fees. I don’t think it’s scammy, but I was a little like…

Revolut paid plan perks

While I don’t love the paid plans, it’s not money out the window. Some tiers give you free subscriptions, let you accrue interest, or grant airport lounge access.

There’s a full, detailed list of perks at every tier on their website. The highest tier, Ultra, claims to provide £5,000 of annual value. I mean, unlimited airport lounge access is pretty swish.

Revolut vs Wise referral programs

You know I love a referral bonus — who doesn’t? So I’d love if you use mine when you’re ready to get Wise or Revolut.

Once you’re signed up, you’ll get your own referral link. You don’t need to be an affiliate or anything. And any bonuses from friends you refer show up in your account as free money.

Wise has been a consistent 75 GBP bonus per 3 friends who sign up. Revolut has varying promotions — I’ve seen anything from 60 NZD to 150 NZD per referral (even with my free account!). And the exact offers also depend on your card tier and what country you registered your account in.

Here’s my Wise referral link, and here’s my Revolut referral link.

But keep this in mind!! If you and your travel buddy are going to download it, don’t do it at the same time.

I mean, obviously if you both want to use my referral link, go ahead. But you may as well help each other out and wait until one of you is fully signed up so you can pass your own referral link on. I hope that makes sense. <3

Read more: Travel Apps You Need for Your Next Trip

Benefits of multi-currency accounts like Wise and Revolut

Whether you go with Revolut or Wise (or both, like me) here are the main ways they’ll make your life better on the road.

Avoid high ATM fees

ATMs are probably the worst offenders when it comes to hidden travel fees.

- The ATM operator almost always charges a withdrawal fee.

- Your bank hits you with a foreign transaction fee.

- The exchange rate your bank uses is usually worse than the real rate.

In Argentina I was losing like 10 USD every time I used an ATM between all the fees/exchange rates. And there was a 100 USD withdrawal limit on most machines, so 10% of my money down the drain every couple of days.

Wise cuts most of that out, making withdrawing cash abroad cheaper and more predictable.

Convert money before you go

In 2026, we’re not going to the foreign exchange bureau before going to the airport. Yes, there are some places you need cash as soon as you arrive. But even still, an airport ATM will usually give you a better rather than the exchange desk.

If you convert your money with Revolut or Wise before you arrive, you can just pull some cash as soon as you land and avoid the inflated exchange rates. Even if you forget to do it before you leave home, you can do it in a few minutes over airport Wi-Fi!

Note: It’s more secure to use your own cellular connection rather than public Wi-Fi. Get an eSIM so you’re not reliant on unsecured networks.

Read more: Is an eSIM Worth It for a Short Trip?

Split your time and money between several countries

Ok so if you’re living somewhere for any significant amount of time, like a year plus, you should get a local bank account. But Wise and Revolut can help you move money between accounts in different countries without expensive fees.

For example, I get paid into my New Zealand account. But when I’m visiting Canada for a few months, I can use Revolut or Wise to send some spending money to my local Canadian account and get a good conversion. This costs me a few bucks at most, depending on how I make the transfer and what the fees are.

When I used to get my NZ/Canadian banks to make the transfers, it was way more expensive and I had to deal with whatever exchange rate they wanted to charge. Wise uses the legit market rate, which I sometimes compare with live rates on XE.

Wise vs XE live exchange rate.

Track your spending more easily

It’s hard to know how much you’re really spending when you’re using another currency. I’m always rounding in my head. So I tell myself 100 USD is basically 150 NZD. But when the exchange fluctuates and is actually $1 USD to $1.60 or $1.70 NZD, those extra bucks I (literally) haven’t accounted for add up quickly.

When you can convert before you spend, you can budget more easily. You can see you have €100 in the account so €100 to spend, not “about $200 NZD.”

Read more: Why TravelSpend Is the Best Budgeting App

Control your cards

We’ve all forgotten a card at an ATM or dropped one during a night out. (Right? right???) And when you have to call your bank to cancel it, it’s a bit of a nightmare.

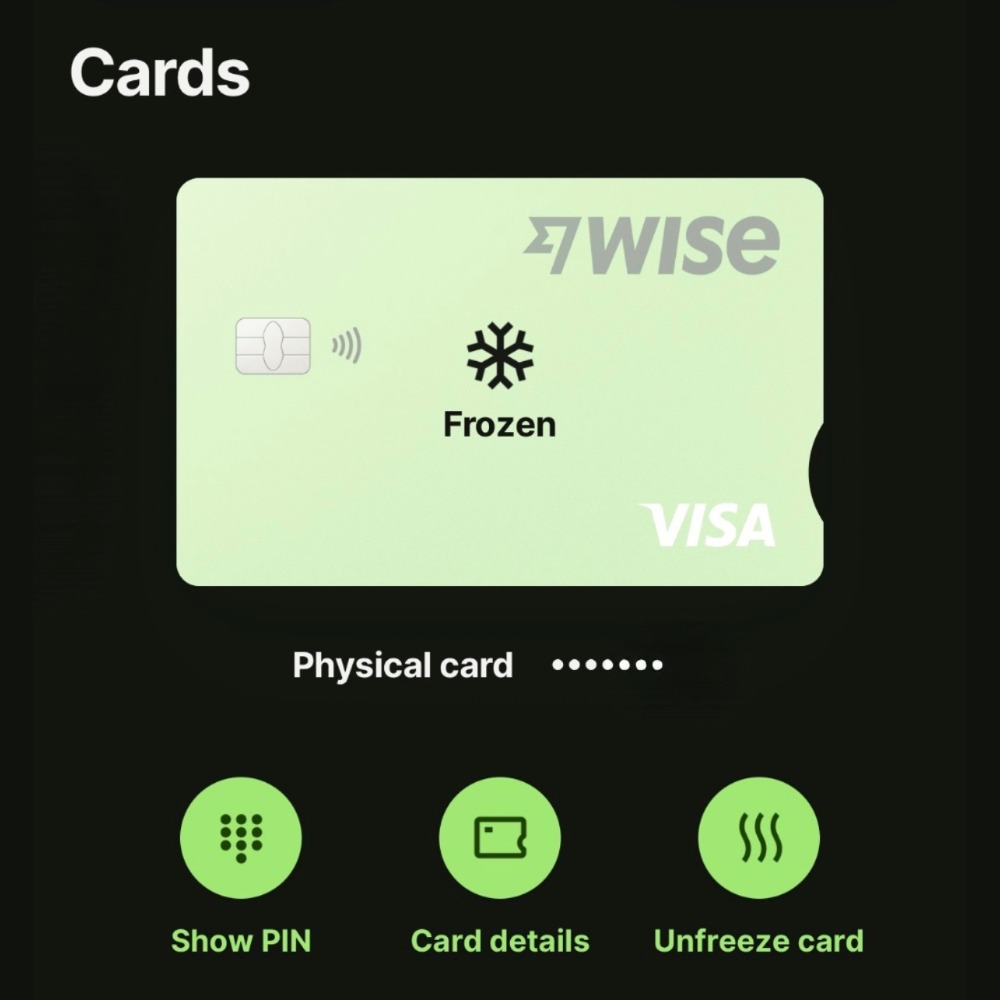

If something goes wrong with your Wise or Revolut card, you can manage it directly in the app. Freeze spending, order a replacement, or transfer your balance to another card without making an international phone call. The freezing is so essential, because sometimes you think something is lost and it turns up later. (Guilty af.)

Your digital card and physical card are also treated separately, so losing the physical card and freezing it doesn’t automatically mean losing access to your digital wallet. You can keep paying with your phone while you sort things out.

Manage everything internationally with ease

There’s nothing worse than trying to make an innocent purchase overseas and having your card get blocked. Or needing a phone with international calling minutes to contact the bank back home.

And I want to scream when my bank tries to send a confirmation text to my home country but I’m on another continent with no access to that number. It’s usually workable, but definitely a huge pain in the butt.

Wise and Revolut are both designed for international use, so they understand you. You still have to register your account to your home address, but they provide other security options when something is suspicious rather than just blocking your card until you phone them.

Downsides to using Revolut or Wise

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- They’re not traditional banks. Wise and Revolut aren’t full-service banks in most countries. Depending on where you live, your money may not be protected in the same way as a traditional bank account with full government deposit insurance. They’re safe to use — but they’re not identical to your regular bank.

- No real credit card rewards. You won’t earn airline miles, Amex points, or major credit card perks. Revolut has some rewards depending on your plan, but it’s not the same as building points through a proper travel credit card.

- You’re responsible for managing limits. There are ATM limits, currency conversion allowances, and plan-based thresholds. If you’re not paying attention, you can run into fees.

- Customer support is mostly app-based. If something goes wrong, you’re dealing with chat support — not walking into a branch and speaking to a human.

- They can make scams easier to execute. This one is important. These platforms are legitimate — but scammers love tools that move money quickly.

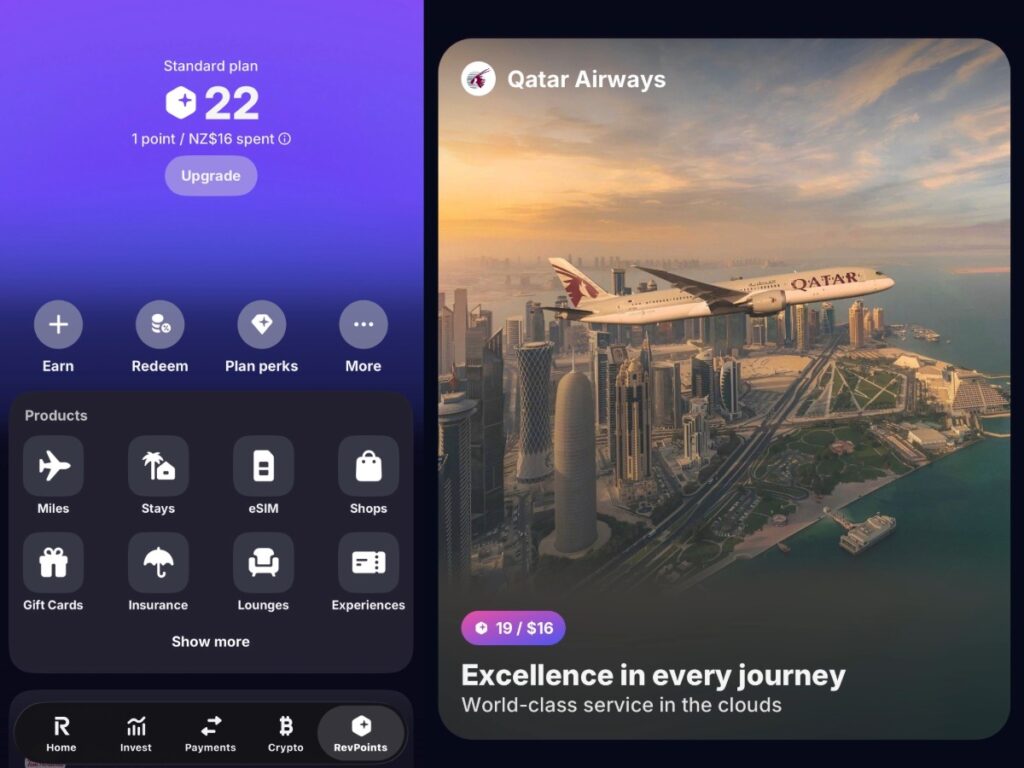

Revolut points system. I have $16 towards a Qatar flight lol.

I cannot stress this enough: Never ever send money to someone you haven’t met in real life. Romance scams (and other types of scams) are very real, and they ask victims to send money through several channels. And you will not get it back. Scammers might choose Wise or Revolut to bypass victims going to bank tellers who are trained to ask questions.

Watch The Tinder Swindler and Hey Beautiful: Anatomy of a Romance Scam for some insight. It’s both fascinating and important to be aware of, especially as AI becomes more prominent.